Data Processing & Visualisation

Data Processing & Visualisation  Data Analytics, Insights & Applications

Data Analytics, Insights & Applications Property tax in Poland and other SCBE countries (Slovakia, Czechia, Bulgaria, Estonia) relies on self-declarations, which often leads to underreported property size or unregistered buildings. As a result, municipalities lose significant revenues, limiting their ability to invest in public services and infrastructure.

LandTaxAssessor addresses this problem by providing local governments with a reliable way to verify reported land use. The solution combines satellite Earth Observation (EO) data with geodetic maps and applies advanced AI algorithms to identify discrepancies, such as undeclared buildings or underestimated property areas.

The objective of the product is to reduce tax evasion, increase municipal revenues, and ensure fair taxation across communities. By delivering fast, regulation-compliant reports through an easy-to-use online portal, municipalities can act quickly without needing in-house expertise in geospatial technologies.

Ultimately, LandTaxAssessor lets local administrations modernise their tax collection processes, strengthen transparency, and recover substantial funds.

The primary customers of LandTaxAssessor are local governments and municipal tax departments in Poland and the SCBE countries (Slovakia, Czechia, Bulgaria, Estonia).

These institutions are responsible for calculating and collecting property taxes, yet they face significant challenges when relying on self-declarations from property owners. Undeclared or underestimated property size, as well as unregistered buildings, create a gap between real land use and reported tax obligations.

The key customer need is a reliable, cost-effective, and user-friendly method to detect tax evasion without requiring in-depth expertise in Earth Observation or GIS. Municipalities need a solution that fits seamlessly into their existing administrative workflows, provides legally compliant results, and delivers them within a short timeframe to support timely decision-making.

With LandTaxAssessor, customers gain access to an online portal where they can request property tax assessments. The service returns AI-driven analyses and regulatory reports, helping local governments identify discrepancies and recover missing revenues. This enables municipalities to increase their budgets and to ensure fairness and transparency in taxation.

The targeted customers are local governments and municipal tax departments in Poland and the SCBE region, specifically Slovakia, Czechia, Bulgaria, and Estonia. These countries share a similar property tax system based on self-declarations from property owners, which makes them equally exposed to risks of underreporting and unregistered buildings. The solution is designed to be directly applicable across these national contexts.

LandTaxAssessor is an online service designed for local governments to improve property tax collection. It integrates Earth Observation (EO) satellite imagery with official geodetic maps and applies advanced AI algorithms to detect discrepancies such as unregistered buildings, underestimated property areas, or changes in land use.

The system is accessed via a secure web portal, optimised for administrative users with no background in EO or GIS. Municipalities can simply submit an analysis request, and within less than four weeks they receive a regulation-compliant report that highlights potential cases of tax evasion. Reports are clear, structured, and ready to support administrative procedures.

A key innovation of LandTaxAssessor is the automated fusion of EO data with cadastral maps and the use of AI-driven building detection. This enables fast, scalable, and accurate assessments that would otherwise require significant time and specialised staff.

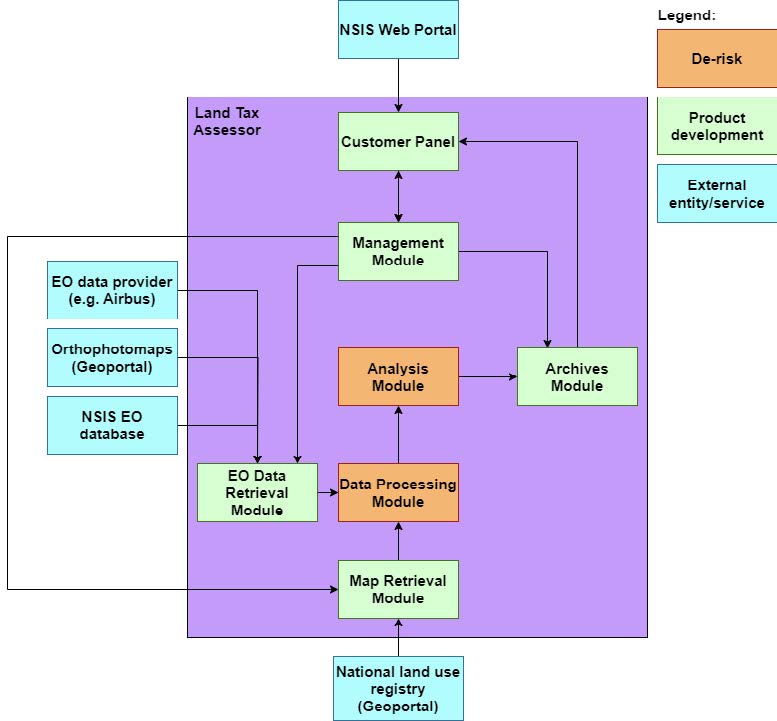

From a high-level architecture perspective, the system consists of:

This approach provides a modern, efficient, and affordable tool for municipalities to strengthen transparency and fairness in tax collection.

LandTaxAssessor brings significant added value compared to traditional methods and existing tools. Today, property tax verification often relies on manual inspections, fragmented cadastral data, or specialised GIS teams, which are costly, time-consuming, and difficult to scale. As a result, many municipalities cannot effectively address underreporting or unregistered buildings.

LandTaxAssessor overcomes these limitations by combining EO satellite imagery with geodetic maps in an automated, AI-driven process. This unique fusion enables fast and accurate detection of discrepancies without requiring in-house GIS or EO expertise. Municipalities access the service through a simple online portal, making the process transparent, user-friendly, and affordable.

Another advantage is turnaround time: LandTaxAssessor delivers complete, regulation-compliant reports in less than four weeks. Competing methods often require lengthy fieldwork or multiple data providers, which delays action. By contrast, LandTaxAssessor’s cloud-based approach scales easily across regions and municipalities, ensuring consistent quality at lower cost. Finally, the solution directly supports sustainable urban development.

By helping cities recover millions of euros in lost tax revenue, LandTaxAssessor lets governments reinvest in infrastructure and community services. The added value comprises improved efficiency and strengthened fairness, transparency, and public trust in taxation.

After the Project Kick-Off on 31 July 2025, the partners launched coordination activities and held several technical meetings to align tasks and responsibilities. Consultations with three pilot towns (Kwidzyn, Piaseczno, and Wołomin) were carried out to better understand their daily operations and expectations. These discussions helped define the final set of use cases.

To gather detailed input, questionnaires and mini-workshops were organised. As a result, two baseline scenarios were developed, focusing on detecting changes in buildings and in land usage registers. The collected requirements, including legal and technical aspects, were analysed and turned into system specifications and design guidelines.

An initial testing programme has also been outlined, and a review of available methods, datasets, and legal regulations has been completed. The first formal review meeting is scheduled for 29 September 2025. The team is now preparing data and starting development of the core algorithms and system modules.