Data Processing & Visualisation

Data Processing & Visualisation  Data Analytics, Insights & Applications

Data Analytics, Insights & Applications Currently, many farmers are unable to access credits to buy inputs such as seed and fertilisers. Women and young people are particularly disadvantaged. With the agriKOPA service, agriBORA creates a credit score which provides more objective access to loans.

Working together with our agriHUBs, agriBORA already provides farmers with inputs, as well as linkage to the markets through contracts with agri-processors. We provide farmers with advice throughout the season, based largely on satellite EO data. But access to credit is generally acknowledged to be a major problem for farmers, negatively affecting their ability to make a living.

Since agriBORA’s major revenue stream comes from commission charged on transactions which take place over our platform, farmers’ lack of access to credit is also a problem for agriBORA.

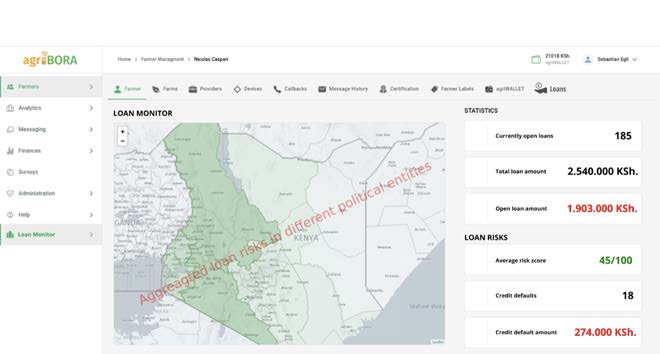

The agriKOPA product produces a credit-score which enables Financial Service Providers (FSPs) to lend with confidence. In addition, during the growing season, EO-based yield forecasts help the lenders to constantly monitor their risk.

We have three main customer groups for our product: smallholder farmers, agriHUBs and FSPs.

Smallholder farmers often lack money for high-quality seeds and fertilizers and also for services like ploughing and soil-testing. With our concept of earmarked loans, we provide farmers with financial resources exactly when they need it.

For agriHUBs and their managers, enabling loans means that the farmers have more money to spend on the products and services provided by the hubs. The agriKOPA service helps the agriHUBs retain their customers and build sustainable businesses.

FSPs see the smallholder farmer sector as risky and inefficient to service. Obtaining the basic data before even considering a loan is difficult and costly. Estimating the creditworthiness is a problem, with women particularly disadvantaged. FSPs also need information on the development of the harvests in regions where they have granted loans, in order to monitor their risks.

The picture below shows an agriBORA “agriHUB”, being visited in connection with the requirements definition phase of the project.

The agriKOPA product will be first introduced in several of counties in Western Kenya. Thereafter, the product will be made available throughout Kenya, with expansion into other African countries also in the planning.

The agriKOPA product is innovative in many aspects. The application of EO data and the compilation of immutable transaction histories using information stored in the agriLEDGER is ground-breaking in the agricultural sector in Kenya. With EO data, agriKOPA monitors crop development and can give timely insights to banks and farmers regarding problems arising. The farmer interacts with this software-as-a-service platform through a phone, via a USSD-code menu, removing the need for a smartphone.

With banks, the interaction will be through an API interface, connecting agriKOPA’s software to the software of the bank. The diagram below shows the service to allow FSPs to monitor their risks.

AgriKOPA’s main competitors provide farming inputs and services at different types of farmer service centres. They provide credit, often linked to insurance policies. Credits are financed directly by the company, or in cooperation with banks.

We bring added value through our innovative credit scoring algorithm and field monitoring which is enabled by Earth observation, machine learning and artificial intelligence.

AgriBORA is the only company which provides a true end-to-end service, ensuring that contracts are in place with agri-processors, thereby providing a guaranteed access to market. This in turn greatly reduces the risk of bad debts for FSPs.

The final presentation took place online in October 2024 and was attended by over 30 people from a variety of different organisations interested in the project results. The final validation of the agriKOPA processes and the systems that support them revealed, in general, a high level of satisfaction among the different stakeholders (farmers, agriHUBs and the bank).

AgriBORA learned a number of vital lessons during pilot operations and validation, which we would not have learned without the agriKOPA project. This has led to some changes to the processes surrounding both lending and repayment.

As a next step, agriBORA plans to run agriKOPA during the long rain season in Kenya, starting in March 2025, involving substantially more farmers and agriHUBs, the first step in a planned rapid upscaling.

The most important lesson learned from agriKOPA was that many farmers are reluctant to sell directly after harvesting, since prices are generally lower. Instead, they store the product on their own premises, which usually leads to considerable loss. Harvest loss is a recognised problem in Kenya and the government has introduced a Warehouse Receipt System as a countermeasure. AgriBORA is now planning to open the first private sector-run warehouse in the country, in the Uasin Gishu County (December 2024), with support from the International Finance Corporation of the World Bank, the Agricultural Finance Corporation of the Kenya Government and the Warehouse Receipt System Council.