Data Processing & Visualisation

Data Processing & Visualisation  Data Analytics, Insights & Applications

Data Analytics, Insights & Applications The core of our offering is an API, seamlessly integrable into any existing software. Within seconds, our system can assess the climate risk associated with assets located anywhere within the European continent, offering a spatial resolution of 30 meters by 30 meters.

A key distinguishing feature of our approach is our commitment to objectivity. Unlike traditional methods that may exhibit historical biases, Eoliann’s methodology revolves around analysing the root causes of events. We continually update our data, prioritising the assessment of causal factors over historical occurrences. This ensures a climate change-proof prediction.

According to a recent study from ECB, up to 30% of the European Banking Credit portfolio is exposed to climate risk. This means that banks may lose the collateral backing their loans, increasing the share of Non-Performing Loans, deteriorating the banking credit score and, consequently, their solvency.

Considering Italy alone, the total banking loans to firms amount to €600 billion, of which 28% are classified as high or very high climate risk exposure according to the Bank of Italy. This implied a potential cost of €168 billion for the banking industry.

This situation highlights how climate disaster poses a severe threat to the financial stability of Europe. To address this, the European Banking Authority (EBA) is demanding that financial institutions integrate climate risk into their risk assessment processes and supervisory framework starting from 2025. Specifically, the regulation requires Banks to integrate the EBA Pillar 3 with an Environmental, Social and Governance (ESG) Prudential scoring. This means that European banks will need to quantify the exposure of their credit portfolio to extreme climate events and disclose this to the banking authority.

Banks will need to estimate how the probability of default (PD) and the loss given default (LGD) of their exposure is affected by natural catastrophes.

All the European continent.

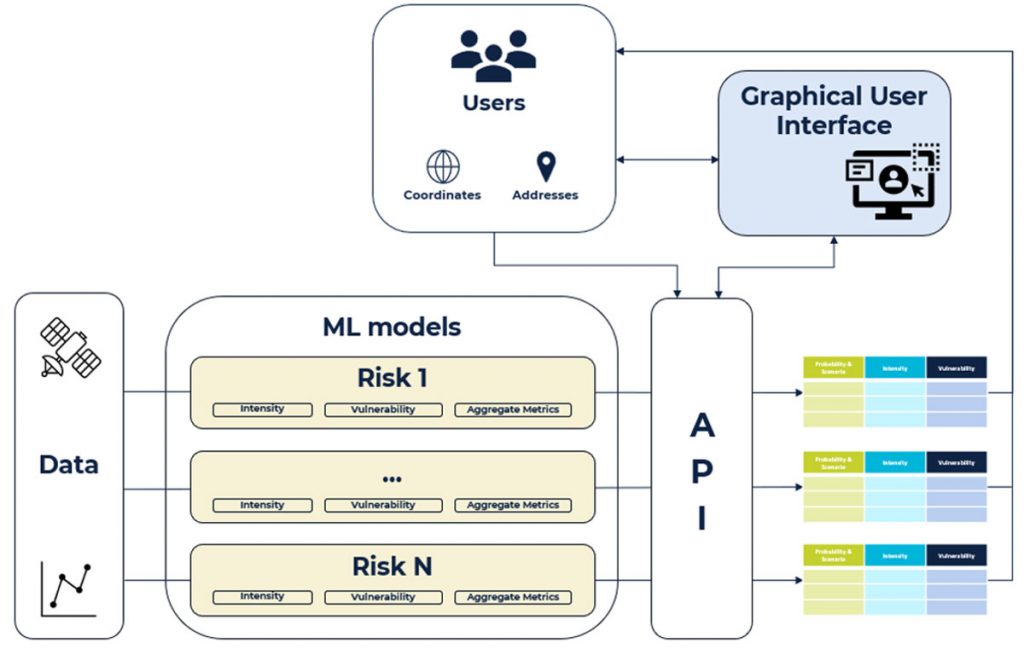

The product consists of an interface providing climate risk assessment data related to different climate risks. The product primarily offers two customer-facing components: an Application Programming Interface (API) as the primary tool for end-users to access and utilise the product, and a Graphical User Interface (GUI) providing non-programmatic access to the data made available via the API. On the backend, a cloud infrastructure manages multiple algorithms, ensuring automation and scalability. These algorithms, rooted in physics, economics, and climate studies, compute the data points served through the API.

The API can be queried on European locations, provided by users either as a textual address or a pair of geographical coordinates. The output resolution is 30 m. The figure below shows the overall architecture and the key modules of the product.

Eoliann’s climate risk assessment solution sets itself apart through several key differentiating and innovative features:

Eoliann ESA InCubed activities and project implementation started on 7 May 2024. Activities have been completed in early May 2025.